Gabe Collins, “Oil From the Bakken and Eagle Ford Shales Can Enhance Global Food Security,” China Oil Trader™, No. 6 (27 August 2012).

CHINA’S OIL & GAS SECTOR FROM WELLHEAD TO CONSUMER

End or reduce the ethanol mandate, make ethanol producers compete on price for their share of the gasoline market, and free up corn supplies by pricing the most inefficient ethanol producers out of the market

Drought in the US Corn Belt—the world’s premier breadbasket—has reduced corn and soybean production and driven corn prices to record levels. Grain shortages hit consumers already suffering from weak economic conditions and in poor countries could drive food riots like those which plagued Egypt, Haiti, Bangladesh, and Sub-Saharan Africa in 2008 during the last major global grain price spike.

Given that ethanol production accounts for nearly 50% of U.S. corn demand, Congress should consider how burgeoning unconventional oil and gas production is providing space to reform U.S. ethanol policy and enhance global food security. The booming Bakken and Eagle Ford Shales and other unconventional oil plays offer an energy efficient way to reduce the use of corn-based ethanol and free up corn for feeding people.

In practical terms, at the current rate of roughly 20 lbs of corn needed to produce a gallon of ethanol, one barrel of crude oil processed in the average U.S. refinery can yield enough gasoline to save 558 lbs of corn. Putting this number in human terms, that single barrel of crude oil replacing ethanol would allow enough corn to flow back into the food supply chain that two people in Mexico, one of the world’s most corn-dependent countries, would have their corn needs secured for a year. Multiply this number across millions of barrels per year of new crude coming onto the market, and there is real potential for meaningfully alleviating the food vs. fuel commodity tug of war the world has periodically experienced over the past five years.

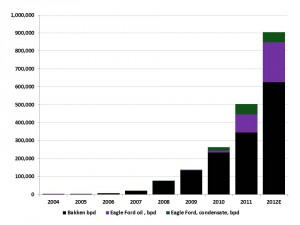

Explosive production growth in the Bakken Shale play and its cousin the Eagle Ford play can make this proposed substitution a reality. Since 2004, the Bakken’s production has risen from 1,400 bbl per day in 2004 to 345,000 bpd in 2011, and the total liquids production from the Bakken and Eagle Ford could hit 900,000 bpd in 2012 (Exhibit 1).

Exhibit 1: Bakken and Eagle Ford Liquids Output

Bpd of crude oil and condensate

Source: North Dakota DMR, Author’s estimate

Compared to crude oil, using ethanol is very inefficient from an energy perspective. In energy terms, it takes 1 unit of energy input[1] to produce 3 energy units of ethanol. In contrast, each unit of energy that goes into refining a barrel of crude oil in the U.S. yields 11.6 units of energy. Corn must be heated before fermentation in order to break down complex starches into simpler sugars—a step that sugarcane-based ethanol production in Brazil does not require because the sucrose-rich juice from cane crushing can go straight into the fermentation vat. In addition, ethanol production requires oil-intensive farm machinery, fertilizers, and pesticides.

Producing ethanol does not completely remove corn from the feed cycle, but it substantially reduces the supply of available starch. Each tonne of corn used to produce ethanol leaves behind approximately 0.31 tonnes of distillers dried grains (DDG. DDG is an excellent protein source for cattle and other animals, but to get the animals the calories they need to fatten up, feeders will have to find additional carbohydrate sources to make up for the corn starch fermented into ethanol. This multiplies grain demand and can lead to supply scarcity and higher prices.

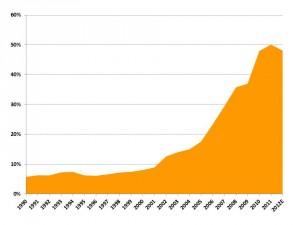

In 2012, the U.S. is on track to use as much as 135.8 million tonnes of corn to produce ethanol—48% of the nation’s likely total 2012 corn demand of 282 million tonnes (Exhibit 2). This is a massive shift from 1980, when less than one million tonnes of corn went to U.S. ethanol plants. Biofuels will constitute an important part of the U.S. and global energy portfolio in the future, but a one-dimensional reliance on corn-based ethanol—with its attendant economic and environmental shortcomings—is not the best approach for maximizing the economic and strategic value of U.S. corn production

Exhibit 2: Proportion of total US corn consumption being used to produce ethanol

Source: USDA, NCGA, Iowa State University Extension

Conclusion

Substituting unconventional oil for the output from the highest cost ethanol producers (say the most expensive 10-15%) would likely provide enough of a marginal corn supply boost to reduce supply and demand pressure across the entire staple grain spectrum (corn, wheat, soy, rice). Congress can create the legal framework for this market solution by either scrapping the ethanol mandate or reducing it over time and also reducing the tariff on imported ethanol from Brazil. Ethanol producers can then compete on price, with new unconventional oil production compensating for the volumes of high-cost ethanol that exit the market because they cannot compete.

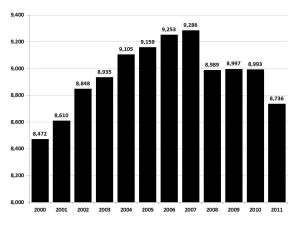

The U.S. gasoline market is contracting, having fallen by nearly 6% in volume terms between its peak in 2007 and 2011 (Exhibit 3). Taken in conjunction with rising unconventional oil production, the gasoline market shrinkage means Bakken and Eagle Ford oil can displace ethanol without adversely affecting the U.S. oil trade balance or motor fuel pool.

Exhibit 3: A Shrinking Gasoline Market Means Less Need for Ethanol to Blend In

Thousand barrels per day

Source: EIA

If the most expensive 10% of ethanol production gets priced out of the market, roughly 13.5 million tonnes of the U.S. corn supply would be freed up for other uses—an amount equal to Mexico’s entire estimated corn consumption during the 2012/13 agricultural marketing year. Making this amount of corn available to the market could play an important role in managing the food vs. fuel competition and bolstering stability by keeping global food prices affordable.

About Us

China Oil Trader™ strives to provide a holistic, globally-oriented analysis of Chinese oil and gas issues. In doing so, we often view multiple asset classes simultaneously and assess how they interact with each other. Our ultimate goal is to provide a focused source of fresh, creative, and anticipatory research for policymakers, investors, and others interested in China’s development as an energy superpower.

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has experience dealing with energy issues for both the U.S. government and as a private sector commodity analyst. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses in outlets including Oil & Gas Journal, The Naval War College Review, Orbis, Geopolitics of Energy, Hart’s Oil and Gas Investor, The National Interest, and The Wall Street Journal China Real Time Report. Gabe also co-founded the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.

[1] Measured in British Thermal Units (BTU)