Quick Note #3

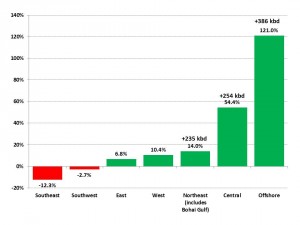

China’s domestic oil production growth has been driven by two regions–offshore and nearshore in the Bohai Gulf (whose production is credited to Northeast China) and by aggressive drilling by Shaanxi Yanchang Petroleum and PetroChina in Shaanxi Province (production credited to Central China). Between 2004 and 2010, net oil production rose by 14% in Northeast China (+235 kbd), 54% in Central China (+254 kbd), and 121% offshore (+386 kbd).

Exhibit 1: Changes in Oil Production, By Region

% change between 2004 and 2010

Source: National Bureau of Statistics

In Northeast China, Tianjin’s production increase of 377 kbd between 2004 and 2010 offset a decline of 132 kbd in Heilongjiang, China’s single biggest oil producing province, a decline of 67 kbd in Liaoning (China’s 7th-largest oil producer) and slight production growth in Shandong and Jilin, China’s 4th and 8th-largest oil producing provinces, respectively.

In Exhibit 1, there is overlap between the production figure for Northeast China and for Offshore. This is because the lion’s share of Tianjin’s output growth comes either from offshore in the Bohai Gulf or from fields either on the coast or in shallow water and reached by directional drilling from shore or from artificially-constructed islands operated by PetroChina. The “Northeast” net increase figure factors in the significant production decline in Heilongjiang and Liaoning Provinces, where production fell by approximately 200 kbd between 2004 and 2010. In contrast, the “Offshore” production figure comes from CNOOC’s oil production in all Chinese offshore waters. Most Chinese offshore oil production growth has come in the Bohai Gulf because the bulk of production in the East and South China Seas comes in the form of natural gas.

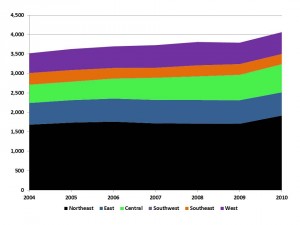

Exhibit 2: Underlying crude oil production by region in China

Thousand barrels per day

Source: National Bureau of Statistics

About Us

China Oil Trader™ strives to provide a holistic, globally-oriented analysis of Chinese oil and gas issues. In doing so, we often view multiple asset classes simultaneously and assess how they interact with each other. Our ultimate goal is to provide a focused source of fresh, creative, and anticipatory research for policymakers, investors, and others interested in China’s development as an energy superpower.

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has experience dealing with energy issues for both the U.S. government and as a private sector commodity analyst. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses in outlets including Oil & Gas Journal, The Naval War College Review, Orbis, Geopolitics of Energy, Hart’s Oil and Gas Investor, The National Interest, and The Wall Street Journal China Real Time Report. Gabe also co-founded the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.