Gabe Collins, “Chinese Oil Traders Will be Big Winners From EU Oil Embargo Against Iran,” China Oil Trader™, No. 5 (24 June 2012).

CHINA’S OIL & GAS SECTOR FROM WELLHEAD TO CONSUMER

China’s May 2012 crude oil imports from Iran hit 524,000 bpd, according to the General Administration of Customs. This is the highest level yet in 2012 and shows that China’s crude purchases from Iran have nearly recovered to their 2011 levels (average of 555,000 bpd) following a price dispute between Unipec and National Iranian Oil Company earlier this year. The restoration of prior import levels suggests Sinopec desires and needs Iranian crude as a core feedstock and that it is unlikely to reduce purchases of crude from Iran even in the face of substantial U.S. pressure.

Even if reported Customs figures show declining imports of Iranian crude in coming months, we would view those data with a healthy dose of skepticism, as Chinese oil traders are the best placed among large global oil traders who could take Iranian crude at a discount and then basically launder it into the market at a substantial profit.

The discounts on WTI oil prices relative to other global benchmarks as a result of shipping bottlenecks in the Midwestern U.S. provide a handy guide to see how big a discount the Iranians might need to apply to entice buyers. Add onto this an additional risk discount to compensate buyers for opposing U.S. and EU sanctions and a price discount of 20% seems reasonable.

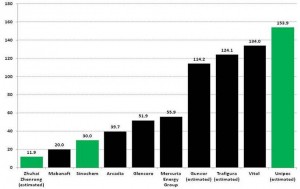

China’s big crude oil traders are already among the world’s largest in terms of volumes moved (Exhibit 1). The embargo and resultant forced discounting of Iranian crude that only a handful of traders will have the political insulation to lift stands to reinforce Chinese traders’ position at the global oil trading table.

Firms such as Zhuhai Zhenrong can avoid normal U.S. and EU leverage channels by using Chinese-flagged and insured VLCCs and also by having Iran ship the oil on some of the 12 VLCCs that Chinese shipbuilders are currently constructing for National Iranian Tanker Company.

The discounted oil would be welcome both to fill China’s strategic petroleum reserves (SPR) and by Chinese refiners who would be happy to emulate the example of the Mid-Continent U.S. refiners who have been able to profit handsomely from discounted WTI feedstock.

Exhibit 1: Chinese oil trading companies among world’s largest by volume

Million tonnes of crude oil sold, 2010

Source: Company reports, International Business Times, Reuters, Author’s estimate

There is likely to be a political tug of war between companies who want to reap immediate profits from refining cut price oil and selling the products at full price and government policymakers who wish to avoid increased real dependency on Iranian crude given the country’s mercurial foreign policy approach and instead want to use the barrels primarily to fill the SPR.

We examined this issue back in January 2012, noting that:

“The EU sanctions, which will affect about 450,000 barrels per day of oil imports to Europe (pdf), will likely engender the transfer of billions of dollars in oil earnings from the Iranian government to China’s main oil trading firms: Zhuhai Zhenrong, Unipec, Chinaoil, and Sinochem. These firms have become major players in the global physical crude oil market. In 2010, 3 of the 10 largest global crude oil and products traders hailed from China…

Of the Chinese oil traders, Zhuhai Zhenrong may be the best positioned to profit because it has strong relationships in Iran and also well-insulated from U.S. and European political pressure that will follow once U.S. and European governments realize that this embargo is likely to be just as leaky as any other. The company enjoys Beijing’s blessing, has no exchange traded stock, has no U.S. assets, and offers virtually no leverage that could be exploited by outside interests seeking to pressure it. Sinochem and Unipec have slightly more exposure to external pressure since their parent companies have parts of the company that are publicly traded, but will still enjoy strong political and diplomatic support from Beijing…

…To make the oil palatable to buyers who want Iranian oil, but do not want to run afoul of U.S. and EU sanctions, traders can blend it with oil from other countries and take other means to disguise the oil’s origin. This is common practice when oil thieves sell oil from Nigeria and one also used by Saddam Hussein’s government, which at points smuggled up to 480,000 barrels per day of oil into the world market despite UN sanctions (pdf). Iran’s heavy crude oil, the country’s largest export stream at present, is similar in weight and sulfur content to the Ural blend that Russia exports, potentially creating swap or trading opportunities. We also anticipate that Iran will trim exports of heavy, higher sulfur crude in favor of more valuable lighter oils that have less sulfur and could be more easily blended and sold into the global market.”

Excerpted from—Gabe Collins and Andrew Erickson, “Chinese Traders Poised to Profit From Iran Oil Embargo,” China Real Time Report (中国事实报), Wall Street Journal, 26 January 2012

Likely outcomes

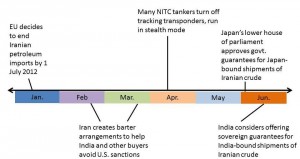

The saga of Iranian oil export sanctions has evolved since January from maritime insurance companies refusing to insure tankers hauling Iranian crude, to Iranian tankers turning off their transponders, to Japan passing a bill that provides government insurance to Iranian oil shipments and China considering use of state flagged tankers to continue moving crude.

Each step of this evolution (see Exhibit 2 timeline) makes the sanctions look more porous and reflects the reality that discounted oil will be hard for a high-growth demander like China to resist. Ultimately, sanctions might hinder Iran’s nuclear progress, but will very likely engender a transfer of wealth from Iran to the Chinese oil traders who can lift an increasing proportion of Iranian crude oil exports.

Exhibit 2: Timeline showing Dilution of EU Oil Embargo Against Iran in 2012

Sources: Council of Europe, Reuters, Bloomberg

Based on the history discussed above, the next announcement we expect would be one confirming that Chinese traders have been lifting cut price Iranian crude and feeding it into the Chinese and global crude oil markets.

Iran needs oil prices to average roughly US$115 per barrel in 2012 to balance its budget, according to the IMF. To boot, the value of Iran’s currency, the rial, has plunged this year, and the government needs funds to maintain services to a sometimes restless population. As such, we believe that Iran has strong incentives to sell oil at heavy discounts rather than obtain no revenue at all for it. Iran’s average oil production cost between 2007 and 2010 was US$26/bbl, according to the Center of Defense of Democracies. As such, even if the country’s marginal cost is twice that number, selling the roughly 750,000 barrels per day of exports currently affected by the sanctions could still yield US$3.8 billion per year in revenue.

In light of these forces, even if China’s reported imports of Iranian crude decline as it negotiates with the U.S, we strongly suspect the actual volume of Iranian barrels flowing into Chinese refineries will at least remain steady, and perhaps increase. The U.S. and China are now negotiating over whether or not Washington will grant Beijing an exemption for importing Iranian crude as it did for India, Japan, and South Korea, who have made efforts to reduce their imports of Iranian oil. As these talks unfold, there are several possible ways forward.

1) Washington can allow Chinese crude oil buyers to argue that by paying a lower price, they are complying with the spirit of the sanctions by denying Iran revenue

2) The U.S. could also allow Chinese crude oil buyers to avoid sanctions by not increasing their Iranian crude purchases beyond a negotiated volume that caps purchases at the 2011 levels Sinopec and PetroChina needed to operate their refineries normally.

3) The U.S. can play politics and continue pressuring China, then turn a blind eye to shadow crude barrels moving out of Iran with the help of Chinese traders.

Given the weaker outlook for global growth and declining oil prices, a combination of the first two scenarios is the highest probability outcome. Lower oil prices deprive Iran of revenue and U.S. can save face politically from a symbolic Chinese “cap” in Iranian imports while China could store and/or refine low price crude it badly needs.

About Us

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has a deeply rooted enthusiasm for the petroleum industry. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses and is an expert contributor to The Wall Street Journal China Real Time Report. He also co-founded and manages the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.