Gabe Collins, “Chinese Drivers Now Pay Roughly One Dollar More per Gallon for Gasoline than U.S. Drivers Do,” China Oil Trader™, No. 4 (13 June 2012).

INSIGHTFUL AND ACTIONABLE ANALYSIS OF CHINA’S OIL & GAS SECTOR.

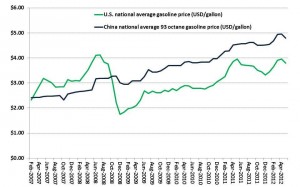

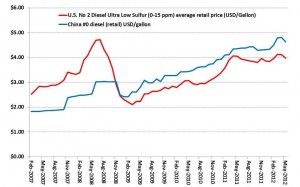

As U.S drivers hit the summer holiday road and grouse about gasoline prices of roughly US$3.57 per gallon, drivers in China are paying roughly US$1 more per gallon for gasoline and 40¢ more per gallon for diesel fuel. The Chinese government’s price setting timetable used to lag U.S. prices but now more frequently updates fuel price guidelines in response to global oil price movements.

The Chinese government’s suggested retail prices for gasoline and diesel now closely track the U.S. monthly average, an important step govern that the U.S. is one of the world’s more market-based motor fuel price benchmarks with its the lower fuel taxes and paucity of motor fuel subsidies relative to markets elsewhere in the world (Exhibit 1). This suggests the NDRC may now be purposely building in a premium that will keep oil demand growth—and China’s oil import dependency—in check.

Exhibit 1: China vs. U.S. retail gasoline prices

Monthly average price, USD per gallon

Source: EIA, NDRC, ORNL, C1 Energy, China Daily, Xinhua, X-Rates

Exhibit 2: China vs. U.S. retail diesel fuel prices

Monthly average price, USD per gallon

Source: EIA, NDRC, ORNL, C1 Energy, China Daily, Xinhua, X-Rates

We would love to see the NDRC provide data on miles driven per year by China’s drivers so that we could get a better sense of how price sensitive Chinese car owners are at the pump. Our suspicion is that because cars are still a luxury status symbol in China, as opposed to the U.S. where rich and poor alike are more likely to rely on personal cars as a primary mode of transportation, Chinese drivers are less sensitive to changes in fuel prices.

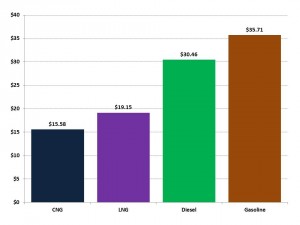

Although the drivers in China may be less price sensitive than U.S. car owners on a “gasoline to gasoline,” “diesel to diesel” basis, it is useful to consider the price differences per million BTU between various potential motor fuels in China. Compressed natural gas (CNG) and liquefied natural gas (LNG) are catching on quickly in China and vehicles can be converted more easily and cheaply to run on these fuels than they can in the U.S.

Currently, #93 gasoline is selling for US$35.71 per million BTU and #0 diesel fuel for US$30.46 (Exhibit 3). CNG sells for roughly half this price per million BTU, while the LNG that fuels large trucks now sells for 37% less than diesel fuel.

Exhibit 3: China motor fuel costs per million BTU, 7 June 2012

USD per million BTU

Source: ENN Energy, China Oil Trader™

The substantial price differences between the gas fuels and oil-based fuels may drive more CNG or LNG conversions on the margin, especially for fleet vehicles such as taxis. In the US, such high diesel prices would drive more freight traffic to the railroads, but China’s rails are already loaded up with coal trains and have less potential for expansion. Also tunnel height constraints put a crimp on the ability for railroads to employ intermodal container shipping in a cost-effective way.

About Us

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has a deeply rooted enthusiasm for the petroleum industry. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses in outlets including Oil & Gas Journal, The Naval War College Review, Orbis, Geopolitics of Energy, Hart’s Oil and Gas Investor, The National Interest, and The Wall Street Journal China Real Time Report. Gabe also co-founded the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.