Gabe Collins, “China’s plans to close “teapot” refineries and liberalize crude oil import rights will impact global crude, fuel oil, and tanker markets,” China Oil Trader™, No. 3 (10 June 2012).

INSIGHTFUL AND ACTIONABLE ANALYSIS OF CHINA’S OIL & GAS SECTOR.

State of play: China’s NDRC aims to close refineries that process less than 40,000 bpd of oil (2 million tonnes per year), in order to reduce pollution and increase energy efficiency. Yet small refiners now account for 2.6 million bpd of capacity, or roughly 1/5 of Chinese oil refining capacity, according to local industry sources. As plants consolidate and begin using crude oil instead of fuel oil as a feedstock, global crude oil, fuel oil, and tanker markets will experience meaningful impacts.

Key market and strategic impacts:

- Major Chinese refiners, especially CNOOC, will likely favor purchasing existing medium sized independent refiners and boosting their utilization rates rather than building new plants.

- The independent refiners will increasingly use crude oil as a feedstock instead of fuel oil. Their demand is likely to impact crudes across the board, as they can run sour barrels.

- Singapore fuel oil prices will likely fall relative to crude.

- Dirty VLCC rates will likely decline significantly as less fuel oil moves from Caribbean refineries into East Asia. As VLCCs move back into the crude trade, rates there could fall as well due to increased capacity.

- As independent refiners gain access to crude and invest in pipelines to bring crude oil in and move refined products out, Shandong’s large oil trucking sector, which has been heavily geared to servicing the independent refiners, will suffer.

- A U.S. angle—If the NDRC continues setting fuel retail prices at substantial premiums relative to the U.S., this could drive motor fuel exports from the US Gulf Coast into China through the soon to be expanded Panama Canal.

A bit about the independent refiners…

Shandong is the epicenter of China’s independent refinery industry. According to oil supplier PetroWin (whose main business is supplying feedstock to Shandong’s independent refiners), Shandong is home to 23 of China’s estimated 64 substantial size independent refineries.

The province’s refiners typically run at 40% or lower capacity utilization rates and play a key role as market balancers when high global crude oil prices and domestic fuel price controls cause Sinopec and PetroChina to suffer losses and cut their output.

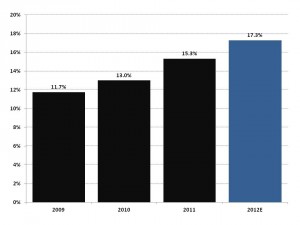

China’s large state-owned refiners virtually monopolize the nation’s crude oil imports, forcing the independent refiners to use straight-run fuel oil as a feedstock. Fuel oil is more expensive than crude oil and puts them at a competitive disadvantage. Despite the central government’s desire to reduce the role of smaller independent refineries, Shandong refiners’ share of national oil refining capacity has steadily risen from 11.7% in 2009 and may account for more than 17% of national refining capacity by the end of 2012 (Exhibit 1).

Exhibit 1: Shandong independent refiners as percentage of national total refining capacity

Source: China Oil and Petrochemicals, China Oil Trader™

In the absence of crude oil supplies, Shandong refiners prefer to use Russian M100 fuel oil in medium and low sulfur grades (i.e. sulfur content of 2.5% or less). The main reason for this is that the central government has only allotted them a crude oil import quota of only about 34,000 bpd—a small fraction of what the local refiners could actually process. The Chinese government has only issued a handful of crude oil import licenses and the crude oil import business is dominated by Sinopec, PetroChina, and CNOOC, leaving most small independent refiners dependent on fuel oil as a feedstock.

This may change soon, as China’s Energy Bureau is now said to be considering a proposal to diversify the country’s crude oil import channels and allow private parties other than the Big 3 state owned oil companies a much freer hand to import crude oil. Independent refineries would likely be the primary customers for the new independent crude oil importers and we expect that the larger refineries might themselves create trading operations to ensure steady crude supplies.

Once they gained access to crude oil, the independents would likely run at higher capacity utilization rates and fill storage tanks to maintain working inventories of crude, increasing China’s crude oil imports—perhaps by 100,000 bpd or more. Higher independent refinery activity would also boost the country’s internal gasoline and diesel fuel supplies, putting downward pressure on prices to the benefit of Chinese drivers and consumers.

Challenges

Until China liberalizes its crude oil import regime, the independent refiners will continue struggling to obtain reliable and competitively priced feedstock streams. In recent years, it has become harder to get fuel oil. Russia and the Middle East—traditional global fuel oil supply centers—are deepening their domestic refinery processing capacity to favor production of higher value added products such as diesel, gasoline, and petrochemicals. The Russian government is considering taxing fuel oil exports at 90% of the rate it taxes crude oil exports at, up from the current 66%. Part of the reason is a simple desire to capture additional revenue, but the key long-term strategic reason is to incentivize Russian oil companies to invest in refinery upgrades that allow them to more thoroughly refine crude oil and produce a greater proportion of higher value added products.

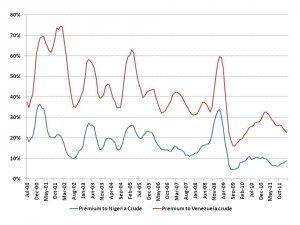

Refiners using fuel oil as a feedstock are at a significant price disadvantage competing with refineries running straight crude oil, particularly sour grades whose prices are usually discounted relative to the global Brent and WTI benchmarks. Over the past decade, fuel oil approximately similar in quality to that used by many Shandong refineries has sold for at least a 15% premium relative to sour crude oils and at least a 5% premium relative to light, sweet crudes (Exhibit 2). Often, the price spread has been much larger. This analysis uses the average monthly price of Venezuelan crude oil exports as a proxy for prices of heavy, sour crude oils and the average monthly price of Nigerian exports as the proxy for light, sweet crude oils.

Exhibit 2: Fuel oil price premium to crude oil, 6-month rolling basis

Source: EIA, China Oil Trader™

The politics of who gets issued crude oil import licenses has—until the current debate—seemed to be driven by the large state controlled companies’ protecting their interests, as opposed to bona fide economic factors. The large companies want the best deal possible on crude going to their own refineries, which is a major part of their trading volume and also likely do not want to have to compete with new privately backed upstarts.

Yet their worries are likely misplaced since the oil import market is likely to naturally remain quite consolidated even if the license regime is liberalized. This is because it is a business that favors economies of scale and large, well-connected traders who can typically supply crude to refiners more cheaply and efficiently than smaller ones can.

Outlook

Larger companies such as CNOOC are helping to consolidate the Shandong refining market by purchasing large stakes in smaller refiners such as Zhongjie. One effect of these purchases is that the smaller companies will then be able to directly access crude oil supplies through their equity partners, as opposed to the more expensive fuel oil feedstock they previously had to use. The smaller refiners also can benefit from access to larger companies’ established retail fuel sales networks.

Smaller refiners are also entering into feedstock supply partnerships with the larger state owned firms. For example, CNPC has agreed to work with Dongming Petroleum to build the RiDong pipeline to supply 20 kbd of crude oil to Dongming’s refinery beginning in late 2011, growing to 40 kbd later (or 1/3 of Dongming’s total feedstock needs). We interpret these emerging crude oil supply partnerships and construction of associated infrastructure as reflecting the larger crude oil traders’ desire to lock up customers before crude oil import regulations potentially become more liberal and allow more importers into the market.

Local motor fuel demand conditions will ultimately determine the rate at which the independent refineries are run. China’s large refiners currently own roughly 25% of the country’s independent refiners. We anticipate the refineries acquired by CNOOC or otherwise consolidated into larger organizations will run at rates more akin to the 85-95% utilization rates that PetroChina and Sinopec refineries typically run at.

Potential additions to Chinese crude oil demand as independent refiners shift feedstocks

As the Chinese independent refiners who do not already have crude oil supply relationships with large state-owned companies begin to make them and switch from fuel oil feedstock to crude oil, crude oil demand growth could be substantial. Also, the demand growth is likely to come from across the crude spectrum, since the independents who previously used fuel oil with sulfur contents as high as 2.5% will be able to run both sweet and sour crudes. For instance, PetroChina has supplied Dongming Petrochemical with Cerro Negro and Merey crudes from Venezuela (both sour) as well as Kazakh crude.

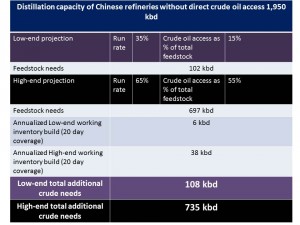

Our tentative estimate is that as the independent refiners switch over to crude oil and build up working inventories, China’s crude oil demand could grow by at least 100,000 bpd and perhaps by as much as 735,000 bpd over the next 18 months (Exhibit 3). The additional crude oil need will not represent an absolute consumption increase of that magnitude because it comes from refiners switching away from fuel oil and over to crude oil and building working inventories. Nonetheless, it will influence the prices of crude and products relative to each other, as well as trade patterns and shipping activity in Asia and beyond.

Exhibit 3: Projected crude oil demand increases as Chinese independent refiners switch away from fuel oil

Source: C1 Energy, Reuters, EIA, China Oil Trader™

About Us

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has a deeply rooted enthusiasm for the petroleum industry. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses in outlets including Oil & Gas Journal, The Naval War College Review, Orbis, Geopolitics of Energy, Hart’s Oil and Gas Investor, The National Interest, and The Wall Street Journal China Real Time Report. Gabe also co-founded the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.