Gabe Collins, “Maquiladoras vs. the Pearl River Delta: A Snapshot of how Rising Wages in China Stand to Influence Global Oil Use Patterns by Moving Manufacturing Closer to Final Consumers,”,” China Oil Trader™, No. 12 (17 January 2013).

CHINA’S OIL & GAS SECTOR FROM WELLHEAD TO CONSUMER

Potential oil demand effects of changing trade patterns deserve attention because the China-Mexico dynamic is unfolding against the backdrop of a broader North American manufacturing revival driven by high oil prices, Chinese labor cost increases, and cheap natural gas brought forth by the U.S. shale gas boom.

For the bulk of the period since 1994 when the North American Free Trade Agreement (NAFTA) came into effect, Mexico saw its competitiveness as an exporter to the U.S. erode in the face of lower cost manufacturing operations in China. However, the current global macroeconomic environment of high oil prices and rapidly rising wages and costs in China is setting Mexico up to displace a meaningful portion of the exports China ships to the U.S.

Even a manufacturing shift of a few percentage points stands to affect oil consumption patterns relative to what they would have been had the trade pattern of the past decade endured unchanged. This is true both in China’s export manufacturing regions and on the transport logistics side. The effect could be substantial, as the export sector accounts for 31% of Chinese GDP (World Bank) and the transportation sector, which depends meaningfully on export activities, accounts for about 58% of China’s diesel fuel consumption.

Chinese wage inflation and high oil prices are changing the game

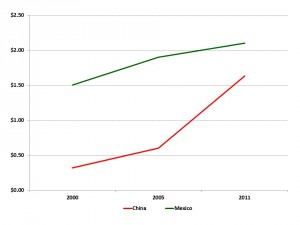

According to data from HSBC, in 2000 the average Mexican worker cost nearly five times as much per hour as his or her Chinese counterpart (Exhibit 1). By 2011, however, the gap had narrowed to 1.2 times, driven primarily by the fact that between 2000 and 2011, the average manufacturing wage in China rose by 409%, while the average Mexican factory worker’s hourly wage only rose by 40%.

Exhibit 1: China and Mexico average manufacturing wages over time

USD per hour

Source: HSBC

Demographic shifts in China account for much of this shift, as the once seemingly inexhaustible pool of young, low cost workers from the countryside is dwindling rapidly as the population ages and the more scarce young workers now demand much better pay and conditions. Mexico still has its flaws, to be sure, including crime and antiquated labor laws, but the relentlessly cost-driven global manufacturing sector is finding a lot to like in Mexico’s increasingly competitive costs, proximity to the U.S., and high use of U.S.-made inputs. Indeed, global real estate investors’ increasing interest in the key Northern Mexican manufacturing hubs for Juarez and Reynosa is yet another piece of evidence suggest that the area is heading for a manufacturing resurgence that will come in part at the expense of Chinese factories.

How much fuel could moving manufacturing from China to the U.S displace?

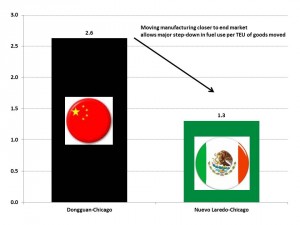

To give a rule of thumb for potential oil demand displacement that new trade patterns could cause, we use barrels of fuel per container shipped so as to provide a metric that can be readily applied to a common measure of trade between countries—the number of shipping containers (“TEUs”) moved between them. In a nutshell, goods produced in Northern Mexico only require about half as much fuel per TEU to reach Midwestern U.S. markets than do goods sourced from Coastal Chinese manufacturing zones (Exhibit 2).

Exhibit 2: Barrels of fuel to move a standard container from China/Mexico to Chicago

Source: Company reports, China SignPost™

Our use fuel calculation for moving a hypothetical container of goods from China or Mexico to the U.S. makes a few assumptions. First, the Chinese cargo originates from the manufacturing hub of Dongguan just north of Hong Kong, while the Mexican cargo comes from Monterrey, Mexico’s industrial capital. Second, our “standard container” weighs 12 tonnes—roughly in the mid-range of potential container weights for a 20 foot long unit. Third, the Chinese cargo comes into the port of LA/Long Beach on a ship that has slow-steamed in order to save fuel, while the Mexican cargo crosses the border by truck at Laredo and then heads north by rail. Both cargoes are headed to Chicago, a proxy for the industrial/consumer heartland of the U.S.

We use a weight-basis for calculating the fuel needed for shipping goods from China and Mexico to the U.S. It is true that cargoes can have a large range of values (imagine a container of grain versus a container full of IPhones!), which makes transport costs vary in terms of how they affect profitability of different goods. But ultimately costs leave money on the table if goods can be sourced from a different place that is located closer to the consumer, and the fuel needs depend more on weight than they do on value since once cargo hits U.S. shores, it typically faces a long overland trip by truck and train where weight matters a lot more for fuel use than it does when a cargo is moved by sea.

Implications for global oil use patterns

Chinese exports to the U.S. are certainly not going to entirely shift to Mexico as wages rise in China. But that said, the analysis above gives insights into how even smaller shifts that favor sourcing goods from Mexico rather than China could have meaningful effects on global use patterns and demand levels for bunker fuel for ships and diesel fuel for trains and trucks.

The evolution of import sourcing into the North American market will be shaped by the following key factors:

- The fact that China’s wages are rising fast and average manufacturing wages near there will likely reach Mexican levels by 2015-2017

- Global oil prices

- The availability of low cost natural gas supplies and cheaper electricity courtesy of the U.S. and Canadian shale gas boom.

- Finally, the state of U.S.-China trade ties. In essence, if increasing acrimony on the political level trickles down in the form of hostile regulations against U.S. investors in China’s manufacturing sector, those aiming to supply Western Hemisphere markets may rapidly decide Mexico is a better place to site factories.

About Us

China Oil Trader™ strives to provide a holistic, globally-oriented analysis of Chinese oil and gas issues. In doing so, we often view multiple classes of commodities simultaneously and assess how they interact with each other. Our ultimate goal is to provide a focused source of fresh, creative, and anticipatory research for policymakers, investors, and others interested in China’s development as an energy and commodity superpower.

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has experience dealing with energy issues for both the U.S. government and as a private sector commodity analyst. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses in outlets including Oil & Gas Journal, The Naval War College Review, Orbis, Geopolitics of Energy, Hart’s Oil and Gas Investor, The National Interest, and The Wall Street Journal China Real Time Report. Gabe also co-founded the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.