Gabe Collins, “How Extensively Could China’s Slowdown Impact Global Oil Prices?,” China Oil Trader™, No. 1 (23 May 2012).

INSIGHTFUL AND ACTIONABLE ANALYSIS OF CHINA’S OIL & GAS SECTOR.

China’s refinery runs actually declined by 0.3% YoY in April. A major Chinese economic slowdown would hit global oil prices, but high marginal production costs, budget constraints in key oil producing countries, and Chinese stimulus measures would likely keep any price decline below $75 per barrel brief.

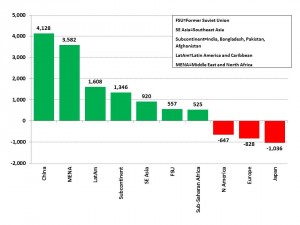

China provided the lion’s share of global oil demand growth over the past decade, adding more than 4.1 million bpd of oil products demand between 2000 and 2011 (Exhibit 1). China actual “apparent consumption” of crude oil was somewhat higher due to the buildup of the country’s strategic petroleum reserves (SPR), which likely accounted for an average of 150,000 bpd of the country’s crude oil use in 2011.

Exhibit 1: Key regions’ contribution to global oil products demand, 2000-2011

Thousand barrels per day

Source: EIA, China Oil Trader™

Major commodity exporters are tightly coupled to the China growth train. China’s appetite for soybeans, iron ore, copper, oil, and other natural resources brings large money flows into producer country economies and allows consumers in Peru, Brazil, Indonesia, and other mineral and agricultural exporters to buy motorbikes, cars, and other oil-intensive items they previously could not afford.

Between 2000 and 2011, the Middle East and North Africa (“MENA”) and Latin America (“LatAm”) added 3.5 million bpd and 1.6 million bpd of oil products demand, respectively. Combined, the five regional blocs that account for the majority of commodity exports to China (MENA, Latin America, Southeast Asia, Former Soviet Union, and Sub-Saharan Africa), accounted for 7.1 million barrels per day of oil products demand increase between 2000 and 2011—1.7 times the amount that China’s demand grew by during that time.

Bottom Line: Major commodity exporters likely won’t be able to decouple if China slows down sufficiently to bring its demand for oil and other commodities into the low single digit range and prices decline substantially. Under such a scenario, global oil demand could suffer a double-impact. If slowing Chinese oil demand reduces prices, key emerging economies that have become substantial oil consumers themselves, but remain dependent on Chinese commodity demand, would likely suffer their own slowdowns as a result.

However, strong supply side factors are likely to buoy prices. National Commercial Bank, the largest lender by assets in Saudi Arabia, says the country’s budget cannot be balanced with an oil price of less than US$71.5 per barrel (Bloomberg). Russia’s budget likely requires an oil price of closer to US$115 per barrel to balance (Reuters), while the marginal all-in production cost of the world’s 50 largest oil and gas producers outside the FSU was US$92 per barrel in 2011, according to Sanford Bernstein. Given these cost and national budget constraints, any price decline to levels below US$75 per barrel during 2012 would likely be short lived.