Gabe Collins, “Profitability Drives Sinopec’s African Oil Investments,” China Oil Trader™, No. 10 (2 December 2012).

CHINA’S OIL & GAS SECTOR FROM WELLHEAD TO CONSUMER

It is important to focus on Chinese NOC’s economic motivations when analyzing their plans for overseas investment in destinations including Africa, Canada, the U.S, and elsewhere. Company managements (both commercial personnel and government bureaucrats) will have additional strategic objectives–such as technology acquisition, but at the core, investments need to be profitable to justify the risk of putting large amounts of capital into faraway oilfields.

Chinese investment in African oil & gas fields often fuels skepticism regarding state-linked companies’ strategic motives. Yet the economic benefits of investing African fields are clear for ambitious corporate managers wanting to advance their careers and for profit seeking shareholders.

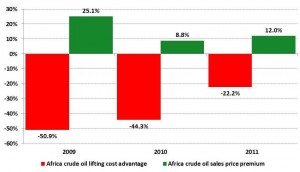

Sinopec’s African operations (primarily offshore Angola) are a minority portion of the company’s total crude oil production—roughly 6% of crude oil output in 2011, but are more profitable than the company’s fields in China tend to be. For instance, Sinopec’s African oil cost 22% less per barrel to produce than the company’s China domestic crude and sold for 12% more per barrel due largely to its higher quality (Exhibit 1). Higher productivity helps the African wells pump at a lower unit cost. Sinopec’s African wells produced nearly 2,800 barrels per day of crude on average in 2011, as opposed to an average rate of only 19 bpd in Sinopec’s core domestic oilfield, Shengli.

Exhibit 1: Attractive Economics of Sinopec’s African Oil Investments

Production cost advantage and sales price premium relative to production in China

Source: Company reports

About Us

China Oil Trader™ strives to provide a holistic, globally-oriented analysis of Chinese oil and gas issues. In doing so, we often view multiple classes of commodities simultaneously and assess how they interact with each other. Our ultimate goal is to provide a focused source of fresh, creative, and anticipatory research for policymakers, investors, and others interested in China’s development as an energy and commodity superpower.

China Oil Trader™ founder Gabe Collins grew up in the Permian Basin and has experience dealing with energy issues for both the U.S. government and as a private sector commodity analyst. He speaks and reads Mandarin, Russian, and Spanish. Gabe has published numerous oil and gas analyses in outlets including Oil & Gas Journal, The Naval War College Review, Orbis, Geopolitics of Energy, Hart’s Oil and Gas Investor, The National Interest, and The Wall Street Journal China Real Time Report. Gabe also co-founded the www.chinasignpost.com analytical portal. He can be reached at gabe@chinaoiltrader.com.